More Investing Tools

Get access to our more investing tools like BRRRR Deals Checklist, Email consult, Premium support, interviews and much more

Not NowYes, Let me in

Get access to our more investing tools like BRRRR Deals Checklist, Email consult, Premium support, interviews and much more

“Compound interest is the 8th wonder of the world.” – Albert Einstein

Of course we love the buy-rehab-rent-refinance-repeat (BRRRR) strategy for investing in real estate. It is the foundation of our portfolio because of its potential for long-term wealth creation, tax benefits and cash flows. Flipping

That said, flipping properties can also be fun, and profitable. We like flips in the case where a BRRRR deal will result in really low cash flow but the property you are buying is located in a hot market, such that it would not rent well but there is a strong demand from homebuyers. For example, we currently invest in the Buffalo, New York market. A good BRRRR is tough to find there because rents in some areas are often low – even in better neighbors often less than $1,000 a month for a three-bed/two-bath – and the taxes are out of control – $3,600 per year for a property built in the 1950s.

So cash flow is tough to come by when you add a mortgage on top of a $320 per month tax bill and are only collecting rent of $1000 per month. That said, the market is absolutely blowing up in terms of the cost of homes – meaning there can be some great flips if you buy right. Ask yourself – how is the market you are investing in – flip-friendly or BRRRR-friendly?.

So let’s shift gears a bit today and discuss the power of compounding and in particular how it can be used to create some amazing wealth through house-flipping. I had fun playing with the compounding calculator on this one and seeing the almost silly size of the numbers it was pushing out.

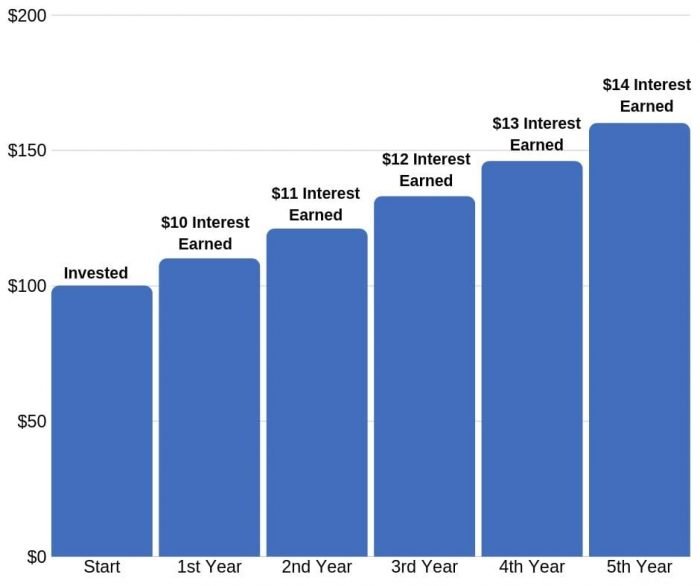

A quick reminder – what is compound interest? Compound interest is the interest that you receive over time as your initial principal amount in an investment gathers interest and then that interest also generates more interest. A simple example – you invest $100 and make 10% annual interest, compounding annually. What does that look like in five years:

You will see that the amount you invested never increased from your initial $100 but that you are earning more and more in interest each year – 40% in year 5 than you earned in year 1. Why? Because your interest is now earning interest at 10% per year as well as your initial capital.

Can this same concept apply to flipping houses? You bet. Under two conditions. You need to not be taking money out of your investments and you must be doing deals. Check out the crazy wealth that can be created with this example:

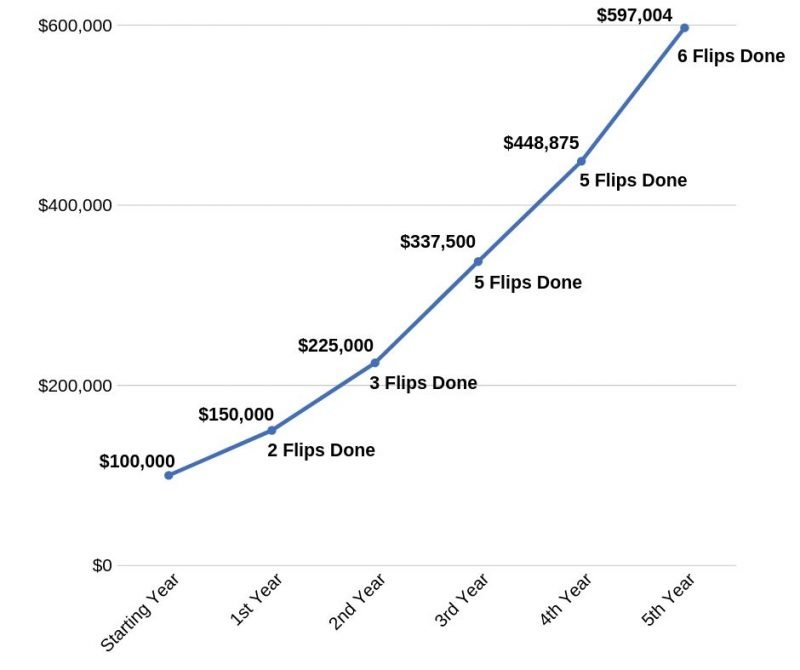

Let’s assume the following facts. You are going to start flipping houses as a side business and you have $100,000 to invest. Your goal is that for the next 5 years you are going to generate a 50% return on your investment capital in years 1 to 3 and 33% in years 4 and 5. So, in other words, in year 1 with your capital of $100,000 you need to generate a profit (after taxes don ́t forget) of $50,000. Realistically, that is a profit that is attainable with two or three good flips. Totally attainable.

In year 2 and all subsequent years you are going to roll in the prior year ́s profit to do even more projects – so you will start year 2 with $150,000 – your initial $100,000 plus the $50,000 you made in year one (remember no taking money out). Years 2 -5 you will do the same. How fast will that initial $100,000 grow and how much work will actually be required to get it there?

These are awesome results. And totally doable. By year 5 you should have this house flipping thing figured out such that six flips in one year is totally possible – result – $597,004 in five years of total profit just by rolling your profits over into new projects. The numbers just get ridiculous from here – but have some fun with it.

Or…you could put your money in the stock market and hope for an annual compound interest rate of maybe 7%. What would that look like and how excited would that get you?

Start of year 1: $100,000

End of year 5: $140,255

I will take the house-flipping option. Sure, it is more work, but it is also more fun. And also makes for a nice little side job that can return big profits if you love real estate like we do and can keep rolling over your money into new projects.

Does this article have you excited about house-flipping? Cool. We have built into our Deal Analyzer, while focused on the BRRRR strategy, the ability to assess your options under a flip scenario – we think you’ll enjoy its versatility and hope you check it out!

___________

Checkout a free trial of our BRRRR All-in-One Solution. The tools in our solution will give you the ability to:

(1) Analyze deals;

(2) Automatically generate offer letters to send to agents and sellers and electronically sign;

(3) Edit and sign contracts that are automatically populated for basic fields and that are modifiable on the site by the user and then downloadable and sendable to contractors, property managers and tenants for electronic signature, all previously-prepared by professional attorneys;

(4) Interview real estate agents, contractors, property managers and lenders and compare them side-by-side; and

(5) Form your own formal business entity to carry out your investing with our Business Formation Toolbox

Get your free trial completely risk-free to do more BRRRR deals than ever before so you can reach all your goals of wealth and financial freedom through the BRRRR strategy. Get signed up!

We love your feedback! Write us anytime!